CGTMSE guaranteed Unsecured Working Capital Loans to MSMEs in India.

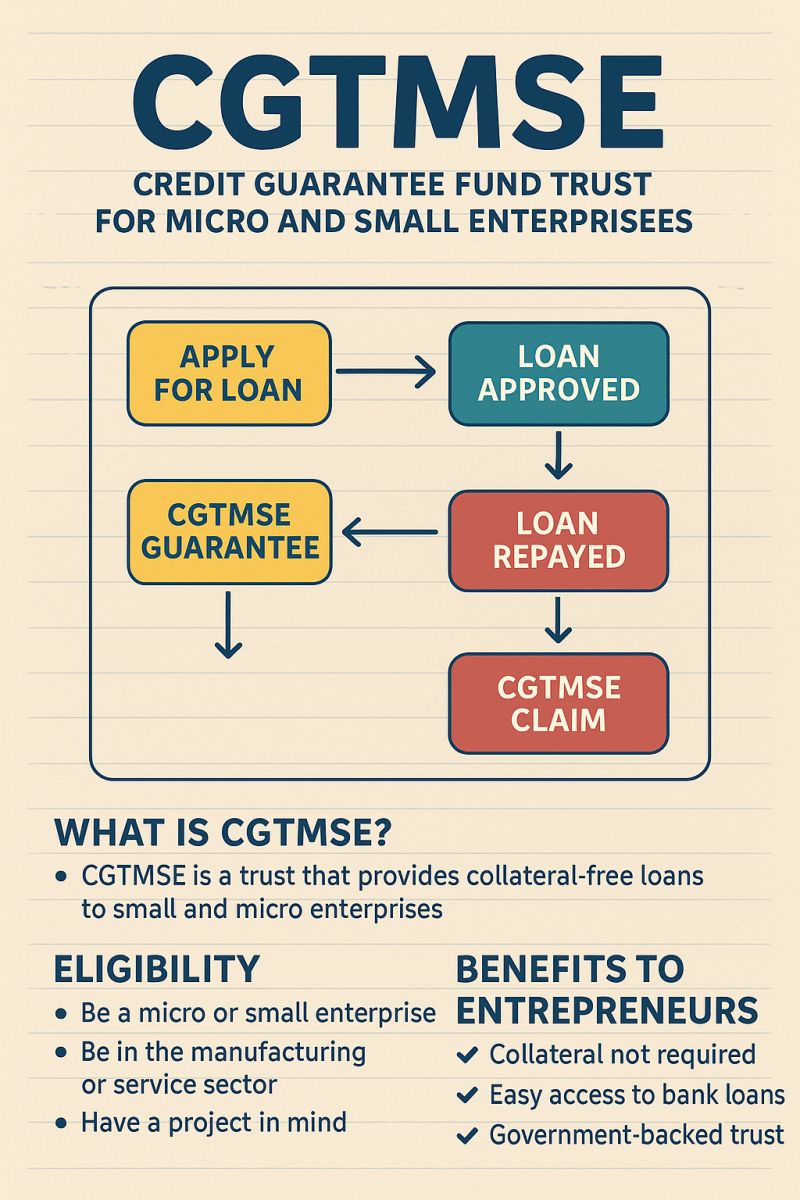

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme, launched by the Government of India and SIDBI in 2000, empowers Indian entrepreneurs by providing collateral-free business loans to Micro and Small Enterprises (MSEs).

It acts as a third-party guarantor, mitigating the risk for lenders and thus encouraging the flow of formal credit to asset-light businesses.

How the CGTMSE Scheme Empowers Entrepreneurs:

The CGTMSE scheme addresses the primary challenge faced by first-generation entrepreneurs: lack of collateral or third-party guarantees.

Key benefits and empowerment mechanisms include:

Access to Formal Credit: It brings unserved and underserved entrepreneurs into the formal banking system by making credit available based on project viability rather than fixed assets.

Risk Mitigation for Lenders: By offering a guarantee cover (typically 75% to 85% of the defaulted loan amount), the scheme reduces the financial risk for banks and Non-Banking Financial Companies (NBFCs), making them more willing to lend to small businesses.

Fostering Entrepreneurship: By simplifying access to finance, the scheme encourages new business formation and expansion, leading to job creation and economic development.

Inclusive Support: Special provisions offer enhanced guarantee coverage (up to 90%) and fee concessions for women entrepreneurs, SC/ST entrepreneurs, and businesses in the North-Eastern Region and Aspirational Districts, promoting financial inclusion across diverse segments.

Support for Growth: Funds can be used for various business needs, including working capital and purchasing machinery / equipment, enabling businesses to scale operations and innovate.

Key Features:

Collateral-Free: No tangible collateral or third-party guarantee is required for the guaranteed portion of the loan.

Maximum Loan Amount: Eligible MSEs can avail credit facilities of up to ₹10 crore as of recent updates (previously ₹2 crore or ₹5 crore).

Guarantee Coverage: The extent of the guarantee cover varies:

Micro Enterprises: 85% coverage for loans up to ₹5 lakh.

Women/SC/ST Entrepreneurs: 90% or 85% coverage.

All Other Categories: Generally 75% coverage.

Eligible Entities: Both new and existing Micro and Small Enterprises engaged in manufacturing, services, and trading activities are eligible.

Member Lending Institutions (MLIs): The scheme is implemented through a wide network of Scheduled Commercial Banks (SCBs), Regional Rural Banks (RRBs), Small Finance Banks (SFBs), and select NBFCs and financial institutions registered with the Trust.

How to Avail a CGTMSE-Backed Loan

Entrepreneurs cannot apply directly to CGTMSE. The process involves working with a Member Lending Institution (MLI):

Prepare a Business Plan: Develop a comprehensive project report detailing the business model, financial projections, and purpose of the loan.

Approach an Eligible Lender: Submit the loan application and business plan to a registered MLI (bank or NBFC).

Lender’s Due Diligence: The MLI will assess the viability of the project and the borrower’s creditworthiness.

Lender Applies for Guarantee: Upon loan approval, the bank applies online to the CGTMSE for the guarantee cover on behalf of the borrower.

Pay Guarantee Fees: The entrepreneur pays a one-time guarantee fee and an annual service fee (based on the loan amount) to the bank, which in turn remits it to the Trust.

Disbursement: Once the guarantee is approved by CGTMSE, the loan amount is disbursed by the bank.

The CGTMSE scheme serves as a crucial backbone for the MSME sector, transforming entrepreneurial aspirations into reality by bridging the gap in formal credit access.

If you need any Guidance or assistance in availing the Loan, please WhatsApp on 91-98200-88394 or email to intellex@intellexconsulting.com

Team- Intellex Strategic Consulting Private Limited

Follow us on LinkedIn:

Ikurre21@gmail.comhttps://www.linkedin.com/company/intellexcfo-com

https://www.linkedin.com/company/intellexconsulting

www.StartupStreets.com, www.GrowMoreLoans.com, www.GrowMoreFranchisees.com, www.intellexCFO.com, www.CreditMoneyFinance.com, www.StartupIndia.Club, www.EconomicLawsPractice.com